Saturday, September 02, 2006

Ultimate Taxation without Representation

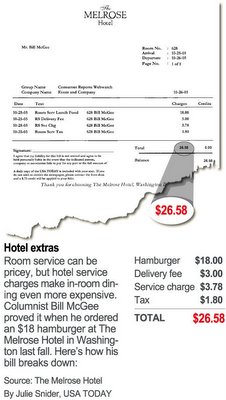

The disturbing trend to off-load tax onto to visiting citizens is hitting new lows around the world. Travelers already pay heavy taxes for everything from hotel rooms to car rentals. Want to rent a car from most major airports, there is a 10-12 percent "convenience fee." Some destinations also charge per-person departure taxes that catch tourists as they leave airports. So long, watch your wallet.

The next wave of "taxes" came from DMF's (Destination Marketing Fees). These DMF's are popping up all over Canada and the United States. These fees are usually 2-4 percent and are now added onto most hotel bills on top of all other taxes. The fees are simply a cash grab in the majority of cases and a prime example "monkey see, monkey do." Toronto was one the first to institute it and soon it was ok for Ottawa to follow suit.

Now, it appears that both the US government and residents in some states are prepared to take these fees / taxes to a new level. The most recent announcement by the US Department of Agriculture that is will begin charging an entry fee for $5 per air passenger to $488 for a maritime vessel, with trucks paying $5.25 and railways $7.50 per car. The cash raised will fund an expanded agriculture inspection program to screen air travellers and commercial rail, truck, ship and plane deliveries for biohazards - read tax grab against a body of individuals who can't directly vote on the measure. The initiative, similar to the US softwood deal, will end up hurting US business (directly and indirectly).

Now, it appears that both the US government and residents in some states are prepared to take these fees / taxes to a new level. The most recent announcement by the US Department of Agriculture that is will begin charging an entry fee for $5 per air passenger to $488 for a maritime vessel, with trucks paying $5.25 and railways $7.50 per car. The cash raised will fund an expanded agriculture inspection program to screen air travellers and commercial rail, truck, ship and plane deliveries for biohazards - read tax grab against a body of individuals who can't directly vote on the measure. The initiative, similar to the US softwood deal, will end up hurting US business (directly and indirectly).

The new lowest of the low, however, comes from America's forgotten state. Alaska voters sent tourists a nasty message last week - Show me the money. The ballot measure, which passed with 52% of the vote and takes effect in 90 days, calls for each tourist arriving via cruise to pay a $50 head tax - apologies to follow in about 40 years.

There are also a series of taxes that could cost cruise visitors even more if other lines pass the levies on to customers. Among them: a 33% tax on casino profits while ships are in Alaska and a corporate tax. The measure calls for revenue to go to port and harbour facilities, to enhance the safety and efficiency of interstate commerce, and for ships' compliance with new environmental regulations. As one voter put it $50 is only fair to compensate for the burden the cruise industry places on Alaska. It must be burden to actually have people visit, buy goods and use services in a state. Maybe some of the citizens should consult facts before they are in line for an unemployment cheque.

Facts:

The cruise industry spent $994 million in the state of Alaska in 2005, a 30 percent increase over the previous year. This spending supported nearly 21,400 jobs, which paid $792 million in wages and salaries, according to an annual economic impact study by Business Research and Economic Advisors (BREA).

Alaska is the premiere cruise destination market in the United States. Due to its northern geographical location, the state is a seasonal destination from late May through September. It received more than 3.2 million cruise passenger visits* – approximately three-fourths of all port-of-call visits at U.S. ports in 2005 and a 12 percent increase over 2004. Alaska’s homeporting operations generated 163,500 passenger embarkations on turnaround cruises between Alaska ports and Vancouver, Canada.

Cruise lines maintain significant tour operations in Alaska and employed more than 2,000 full- and part-time employees during 2005. During the peak cruise season, lines employed more than 3,000 workers and averaged about 2,000 full-time equivalent employees. Alaska ranked fourth in the United States, after Florida, California and New York, at $994 million in direct cruise industry spending. Tourism-related businesses such as tour operators, airlines, hotels, restaurants and ground transportation providers received approximately $730 million, slightly more than 80 percent of the industry’s direct expenditures in Alaska. Another $45 million was spent with food processors, construction firms, employment agencies, trucking and utility companies.

Americans are so pre-occupied with homeland security and the blaming of other countries for the potential threats, that most can't process a rationale thought on the matter. Security is a legitimate concern, however, the cost should be borne by those who are being secured full-time, not from Luke the Drifter.

The next wave of "taxes" came from DMF's (Destination Marketing Fees). These DMF's are popping up all over Canada and the United States. These fees are usually 2-4 percent and are now added onto most hotel bills on top of all other taxes. The fees are simply a cash grab in the majority of cases and a prime example "monkey see, monkey do." Toronto was one the first to institute it and soon it was ok for Ottawa to follow suit.

Now, it appears that both the US government and residents in some states are prepared to take these fees / taxes to a new level. The most recent announcement by the US Department of Agriculture that is will begin charging an entry fee for $5 per air passenger to $488 for a maritime vessel, with trucks paying $5.25 and railways $7.50 per car. The cash raised will fund an expanded agriculture inspection program to screen air travellers and commercial rail, truck, ship and plane deliveries for biohazards - read tax grab against a body of individuals who can't directly vote on the measure. The initiative, similar to the US softwood deal, will end up hurting US business (directly and indirectly).

Now, it appears that both the US government and residents in some states are prepared to take these fees / taxes to a new level. The most recent announcement by the US Department of Agriculture that is will begin charging an entry fee for $5 per air passenger to $488 for a maritime vessel, with trucks paying $5.25 and railways $7.50 per car. The cash raised will fund an expanded agriculture inspection program to screen air travellers and commercial rail, truck, ship and plane deliveries for biohazards - read tax grab against a body of individuals who can't directly vote on the measure. The initiative, similar to the US softwood deal, will end up hurting US business (directly and indirectly).The new lowest of the low, however, comes from America's forgotten state. Alaska voters sent tourists a nasty message last week - Show me the money. The ballot measure, which passed with 52% of the vote and takes effect in 90 days, calls for each tourist arriving via cruise to pay a $50 head tax - apologies to follow in about 40 years.

There are also a series of taxes that could cost cruise visitors even more if other lines pass the levies on to customers. Among them: a 33% tax on casino profits while ships are in Alaska and a corporate tax. The measure calls for revenue to go to port and harbour facilities, to enhance the safety and efficiency of interstate commerce, and for ships' compliance with new environmental regulations. As one voter put it $50 is only fair to compensate for the burden the cruise industry places on Alaska. It must be burden to actually have people visit, buy goods and use services in a state. Maybe some of the citizens should consult facts before they are in line for an unemployment cheque.

Facts:

The cruise industry spent $994 million in the state of Alaska in 2005, a 30 percent increase over the previous year. This spending supported nearly 21,400 jobs, which paid $792 million in wages and salaries, according to an annual economic impact study by Business Research and Economic Advisors (BREA).

Alaska is the premiere cruise destination market in the United States. Due to its northern geographical location, the state is a seasonal destination from late May through September. It received more than 3.2 million cruise passenger visits* – approximately three-fourths of all port-of-call visits at U.S. ports in 2005 and a 12 percent increase over 2004. Alaska’s homeporting operations generated 163,500 passenger embarkations on turnaround cruises between Alaska ports and Vancouver, Canada.

Cruise lines maintain significant tour operations in Alaska and employed more than 2,000 full- and part-time employees during 2005. During the peak cruise season, lines employed more than 3,000 workers and averaged about 2,000 full-time equivalent employees. Alaska ranked fourth in the United States, after Florida, California and New York, at $994 million in direct cruise industry spending. Tourism-related businesses such as tour operators, airlines, hotels, restaurants and ground transportation providers received approximately $730 million, slightly more than 80 percent of the industry’s direct expenditures in Alaska. Another $45 million was spent with food processors, construction firms, employment agencies, trucking and utility companies.

Americans are so pre-occupied with homeland security and the blaming of other countries for the potential threats, that most can't process a rationale thought on the matter. Security is a legitimate concern, however, the cost should be borne by those who are being secured full-time, not from Luke the Drifter.

Comments:

<< Home

Good report on the Alaska cruise industry. Obviously you did some homework.

I was one of the 48% who voted against Ballot Measure 2. I saw it for the bureaucratic and burdensome scam that it was. Unfortunately, four years of an ethically-challenged Murkowski administration generated a bore tide of reform that not only swept Sarah Palin to the Republican gubernatorial nomination over Frank Murkowski, but also persuaded 75% of Alaskans to vote yes on Ballot Measure 1 (campaign reform). This tide of reform was also enough to put Ballot Measure 2 over the top, also.

In a normal election year, Ballot Measure 2 would not have passed. And already, the backlash has begun. During the past two days, the Anchorage Daily News published two letters from non-Alaskans decrying Ballot Measure 2.

However, Alaska state law allows the state legislature to amend or overturn ballot measures after 2 years. This means it could be flushed during the 2009 legislative session at the earliest.

I was one of the 48% who voted against Ballot Measure 2. I saw it for the bureaucratic and burdensome scam that it was. Unfortunately, four years of an ethically-challenged Murkowski administration generated a bore tide of reform that not only swept Sarah Palin to the Republican gubernatorial nomination over Frank Murkowski, but also persuaded 75% of Alaskans to vote yes on Ballot Measure 1 (campaign reform). This tide of reform was also enough to put Ballot Measure 2 over the top, also.

In a normal election year, Ballot Measure 2 would not have passed. And already, the backlash has begun. During the past two days, the Anchorage Daily News published two letters from non-Alaskans decrying Ballot Measure 2.

However, Alaska state law allows the state legislature to amend or overturn ballot measures after 2 years. This means it could be flushed during the 2009 legislative session at the earliest.

www.torontoharbour.com

www.merrycruises.ca

www.publiccruises.com

www.rochestertourism.com

www.torontodinnercruises.com

www.torontoplace.com

www.merrycruises.com

www.torontocruiselines.com

Post a Comment

www.merrycruises.ca

www.publiccruises.com

www.rochestertourism.com

www.torontodinnercruises.com

www.torontoplace.com

www.merrycruises.com

www.torontocruiselines.com

<< Home